A Perfect Storm: How Record-High Office Vacancy Rates and Remote Work Trends Threaten Regional Banks

The banking industry has weathered many storms, from recessions to technological disruptions, yet its foundation is shaking once again. This time, the tremors come from an unlikely catalyst—remote work, a trend supercharged by the pandemic that has led to a startling increase in office vacancy rates. The impact of these developments could pose a particularly harsh blow to regional banks, entities with assets under $100 billion that also hold a considerable amount of U.S. Treasury bonds, potentially exacerbating the challenges.

A Brief Flashback to March 2023: The Near-Collapse

The state of regional banks took a disturbing turn in March 2023. Not only were these institutions saddled with about $700 billion in unrealized losses from sinking Treasury bond prices (attributed to inflation and interest rate hikes), but they were also on the brink of a nationwide bank run due to massive deposit flight as consumers chased after higher yields.

The Federal Reserve’s decision to increase interest rates in 2022, aimed at controlling inflation, led to a corresponding increase in money market fund (MMF) yields. Traditional bank savings account yields could not keep pace, causing a deposit exodus from banks to MMFs. A downward spiral began with dwindling commercial bank deposits and a surge in MMF assets throughout 2022 and into 2023.

Fortunately, a crisis was averted as the Federal Reserve intervened, injecting $100 billion of liquidity into struggling banks through the Bank Term Funding Program (BTFP) in 2023. This helped ease depositor concerns and sparked a rally in the regional banking ETF ($KRE).

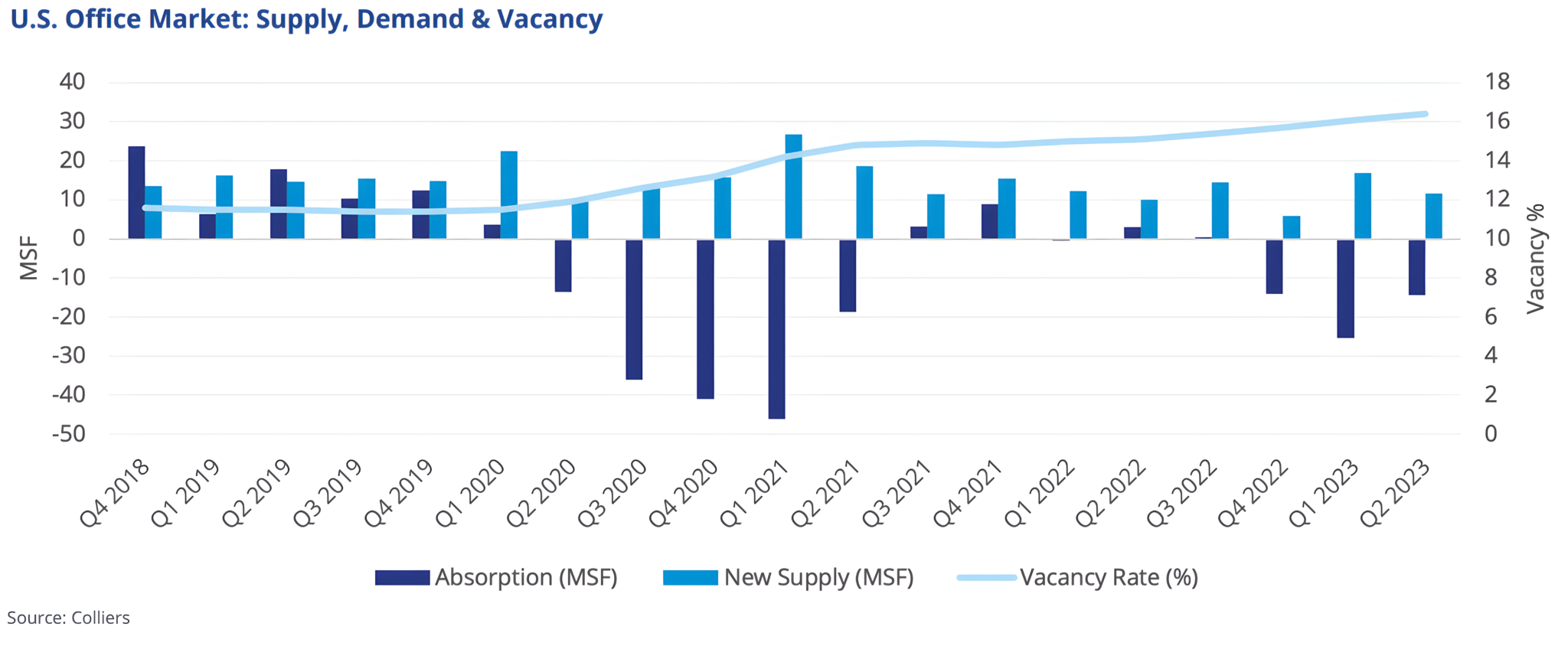

Courtesy – Colliers Q2 2023 Office Market Outlook

But the Pressure Mounts Again

While the BTFP initiative has undoubtedly provided temporary relief, the underlying issues remain largely unaddressed. Regional bank earnings have continued to decline due to the burden of high interest rates, despite the Fed’s efforts to shore up confidence and deter further depositflight.

The Elephant in the Room: Commercial Real Estate (CRE) Loans

An equally ominous concern for regional banks is their high exposure to Commercial Real Estate (CRE) loans, which are becoming increasingly risky. Small banks tend to have the highest concentration of such loans. The default rate on CRE loans has seen a sharp rise since 2022, largely due to businesses struggling to generate sufficient revenue from their commercial properties. With office spaces gathering dust thanks to the remote work revolution, the CRE loans are rapidly becoming toxic assets on regional banks’ balance sheets. Most of these loans are due in 2024 and 2025, which sets the stage for a potentially significant challenge to holders of these loans.

The Long-Term Implications

While we may not be staring down a banking crisis akin to 2008, the odds are that regional banks will be forced into a more conservative stance, tightening their lending practices, and reducing the number of loans they offer. In an economy that thrives on credit, this is not a negligible issue. Reduced lending will likely translate into lower economic growth, creating a ripple effect that could resonate far beyond the banking sector.

Investor’s Note: Navigating Volatility

In this uncertain landscape, investors need to exercise extreme caution. With regional banks representing a significant component of the U.S. financial system, their challenges can have broader market implications; therefore, closely monitoring CRE exposure among banks will become essential to effectively managing portfolios dedicated to the sector.

A storm is indeed brewing for regional banks, intensified by factors ranging from interest rate hikes and remote work trends to precarious commercial real estate loans. While the Federal Reserve’s intervention has kept the wolves at bay for now, the financial weather forecast for regional banks remains highly uncertain. The ramifications will not just be confined to these banks but are likely to reverberate through the U.S. economy at large, making this a critical issue that deserves our utmost attention.

So, as we watch this narrative unfold, it’s clear that the traditional banking sector, particularly at the regional level, will need to adapt to these challenging conditions to maintain financial stability and investor confidence. What that evolution will look like in an era of remote work and high office vacancy rates is a question that has yet to be answered. But what is certain is that industry cannot afford to ignore the storm clouds gathering on the horizon.

Q3 2023: Navigating Uncertain Waters with Lambert

For regional banks finding themselves at the intersection of changing work patterns, financial market dynamics, and a complex regulatory landscape, the challenges are undoubtedly daunting. Now more than ever, transparent communication, strategic financial planning, and proactive stakeholder engagement are not just optional—they are vital for survival and growth.

Lambert’s Investor Relations practice offers specialized support aimed at helping regional banks navigate these choppy financial waters. The perfect storm may be brewing, but with proactive action, you can navigate through it successfully. Reach out to Lambert’s Investor Relations today for a complementary consultation to explore how we can assist your regional bank in facing the upcoming challenges head-on. Together, we can turn these challenges into opportunities for innovation and long-term growth.