By Jeff Tryka, CFA, Senior Director

A while ago, a colleague asked what I thought would happen if a company decided to cut or eliminate their dividend, to which I flippantly replied, “nothing good!” Across the recent pandemic, as a broad range of companies have decided to cut or eliminate dividends, suspend stock buybacks and implement other methods to conserve cash, I’ve thought more about this topic and what really would happen. How would institutional shareholders respond to such news? Would they immediately sell, or would they be more disciplined in their approach?

In an effort to come to some sort of answer, or at least provide some insight into the question, I decided to look at a dozen companies that announced dividend eliminations or significant cuts in the weeks prior to March 31, 2020. I chose this cutoff in order to determine relatively quickly the impact on institutional holdings through the 13F filings deadline at that date. I admit, I have some vested interest in two of the 12, as I previously owned both Ford Motor Company and Freeport McMoran – mainly for their dividends – and immediately sold both stocks after they announced the suspension of these dividends. The remaining 10 companies were selected from a range of industries, with varying pandemic impacts, so the changes in holdings may be due to more than just the dividend cuts. The first question I asked was, “What happened to total institutional holdings of these companies?”

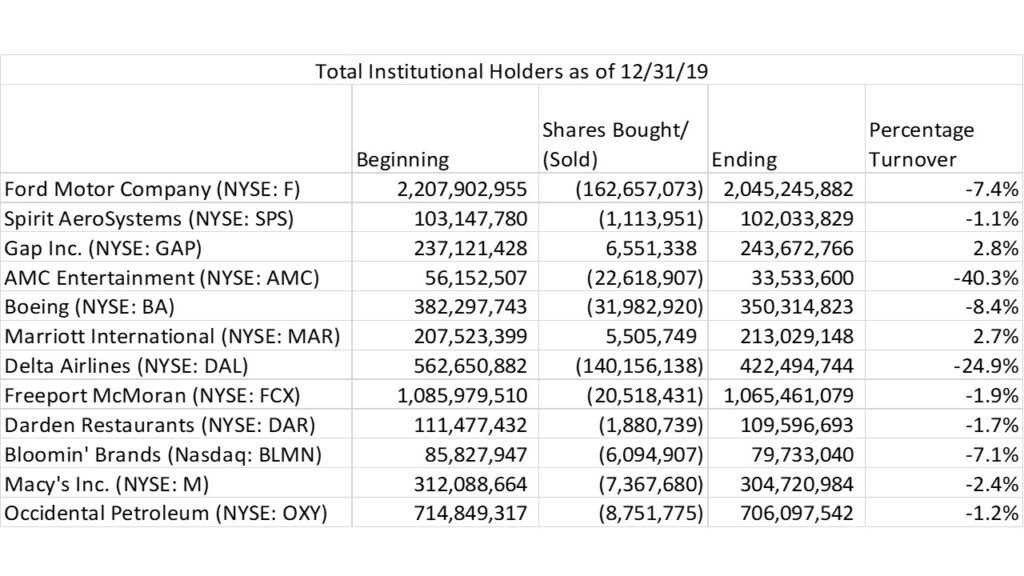

As you can see from the following table, there are a few surprises. First, there were two companies that saw an increase in institutional holdings, Gap Inc. and Marriott International. I expected that every company would have experienced institutional selling at varying degrees. Second, there were two companies that experienced far more selling than the average, AMC Entertainment and Delta Airlines. This might be more to do with the impact of COVID-19 on their respective businesses rather than simply due to a dividend cut, though this might be a factor in all the companies examined. The overall average turnover percentage (shares sold divided by the beginning number of institutional shares held) was just 7.6%, but when you exclude the two big outliers, that percentage drops to just 2.6%. This is far from the disaster I was expecting.

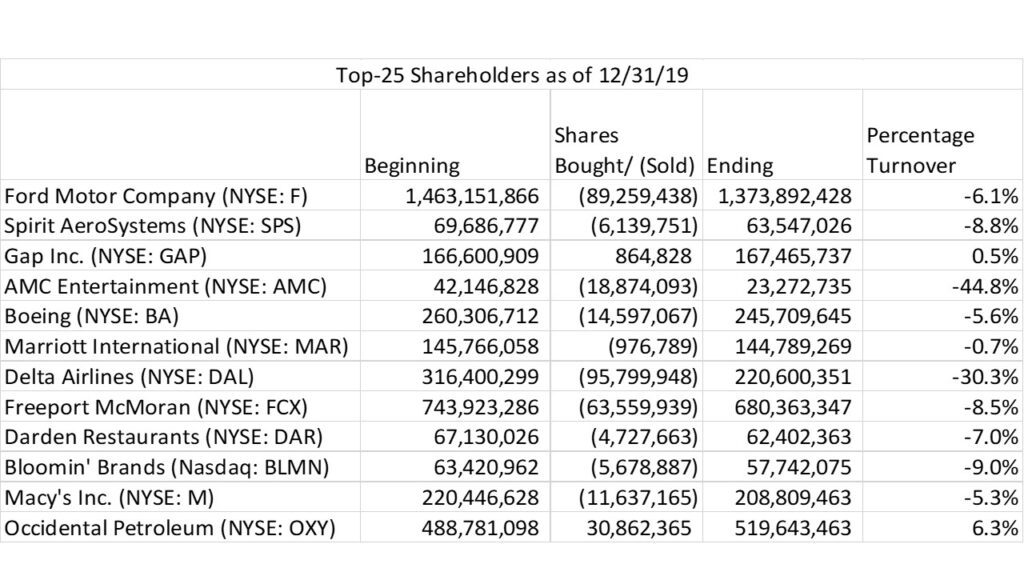

Next, I decided to look at turnover among the top-25 institutional holders for each company.

Within this group, there was a higher level of turnover, suggesting that although the overall level of institutional holdings might change modestly, the changes in positions of larger holders is more acute. Once again, two companies saw increases in overall positions in the top 25, though looking deeper into the numbers, one company –, Occidental Petroleum –had two large holders that added a combined 95 million shares to their position. Overall, the average turnover percentage among the top-25 holders was higher at 9.9%, though that drops to 4.4% excluding the two outliers mentioned earlier.

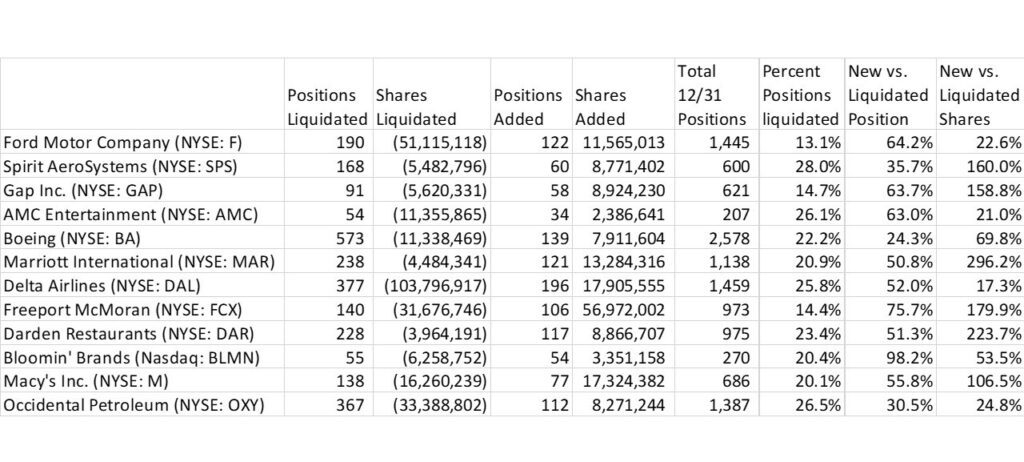

The final area I looked at was the level of institutional liquidations compared to new institutional positions initiated.

Upon review, I identified where the challenges from a dividend cut might make the work of IR professionals a bit more challenging. First, on average, 23.1% of institutional holders liquidated their positions entirely. Replacing nearly a quarter of shareholders is a daunting task for even the most seasoned IRO. Second, for those institutions liquidating, only 55.4% were replaced by holders establishing a new position (and keep in mind, although timing is not a part of the quarterly 13F filing, I suspect the new positions may have been established throughout the quarter, while the liquidations may have been concentrated after the dividend cuts were announced). Finally, some encouraging data on the number of shares purchased by new holders compared to those positions liquidated suggests that new buyers were more than offsetting the shares sold. With the ratio of share purchases to liquidations at 111.2%, it seems that the task of replacing those lost holders might not be as daunting as it looked at first.

While this analysis produced some numbers to support my original flippant answer to the question, there are a number of steps IR professionals can take when assessing the potential for a dividend cut or suspension. First, identify any holders that are classified as “dividend” or “income” funds, as they will be the first holders to liquidate. Second, amongst your top holders, look closely at their mandate and investment criteria. Some funds only invest in companies that are growing their dividends, so the first cut will result in the selling out of their positions. When identifying the most likely firms to sell, start to assess the most likely impact of the news on the shareholder base and begin the process of targeting for rebuilding that base. Finally, carefully consider how to communicate the company’s action. Many, if not most, investors view a dividend cut as a sign of more trouble ahead. If the action is truly temporary to address cash flow during a global pandemic, communicate that message clearly. Talk with shareholders and reassure them of the core business and how the company is managing current conditions. Open communication and transparency with institutional holders can help to cushion the impact of a dividend cut or suspension.